MONA M03, the "steel wire" at the foot of Xpeng Motors.

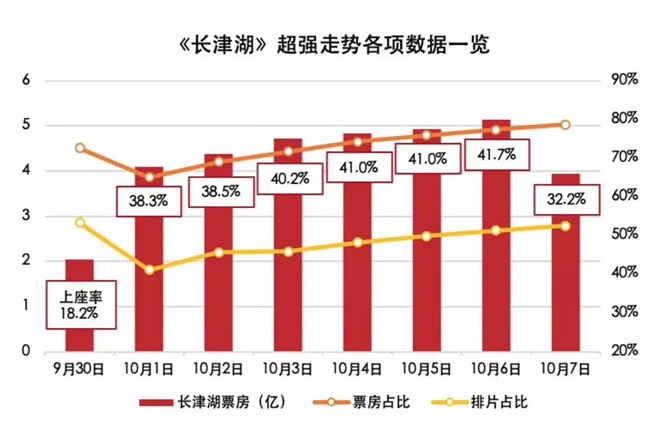

On September 1st, Xpeng Motors released its sales results as usual. Data show that from January to August this year, the cumulative sales volume in Xpeng Motors was 77,209 vehicles, up 17% year-on-year, which is far from the annual sales target of 280,000 vehicles set at the beginning of this year.

On August 27th, it went public. According to the official, orders exceeded 10,000 units after 52 minutes of sale, and orders broke 30,000 units after 48 hours of listing.

Compared with the actual delivery volume, there is a certain "moisture" in the order volume. For most brand models, users can unsubscribe after paying the deposit.

However, MONA M03 in Tucki gained a high popularity in a short period of time, which still injected confidence into Xpeng Motors invisibly. Perhaps, can Xpeng Motors achieve or approach the goals set at the beginning of the year in 2024; This car will play a key role in whether Xpeng Motors can return to the first echelon of new car-making forces in the future.

However, while Tucki MONA M03 may have the ability to bring Xpeng Motors back to life, this car will also bring greater challenges to Xpeng Motors.

Life in Xpeng Motors is hard.

At present, except for a few brands, many brands in China automobile industry are having a hard time. Downward sales, internal layoffs, and the glory of the joint venture brand is gone; Weimar, Gao He and other once brilliant new forces in building cars have either gone bankrupt or been sentenced to death with a reprieve; Traditional strongmen such as the Great Wall and Ai ‘an are facing great sales pressure this year after experiencing their own highlights.

Many years ago, many experts and scholars thought that only a few brands would "survive" in China’s automobile industry in the future. Recently, Xpeng Motors, chairman and CEO, once again publicly stated this view: "In the next 10 years, there will be only seven mainstream brands in China."

FAW, Dongfeng, Chang ‘an, BAIC, SAIC, GAC, Geely, BYD, Great Wall, Weilai, Tucki, Ideality, Sailis, Jianghuai, etc., are not joint venture brands, but only self-owned brand car companies, and there are not only seven casually.

In He Xiaopeng’s mind, among the brands that will "survive" after 10 years, there will definitely be Xpeng Motors. However, if there are only seven "places" in the end, besides He Xiaopeng and his die-hard, who will firmly believe that Xpeng Motors will be included?

Just look at the new forces camp, as one of the "top cards", Xpeng Motors has been in a state of obvious backwardness. In the first eight months of this year, the cumulative sales volume in Xpeng Motors was less than 80,000 vehicles, and the average monthly sales volume was less than 10,000 vehicles. Xpeng Motors’s opponents, however, are mostly in a state of triumph.

From January to August, Weilai Automobile delivered a total of 128,000 new cars, LI delivered a total of 288,000 new cars, retail cars delivered 140,000 new cars, and HarmonyOS Zhixing delivered 270,000 new cars. Among the mainstream brands of new power in car making, the sales volume is not as good as that of Xpeng Motors.

Not only did sales fall short of expectations, but Xpeng Motors was also under pressure in financial reporting.

According to the latest financial data released by Xpeng Motors, in the first half of this year, Xpeng Motors suffered a net loss of 2.65 billion yuan, of which in the second quarter, the net loss was 1.28 billion yuan. At the same time, in terms of gross profit margin, Xpeng Motors’s gross profit margin in the first half of this year was 13.5%, although it reversed the negative gross profit margin in the same period last year. However, there is still a big gap between LI and the first echelon, and the gross profit margin of LI in the first quarter remains around 20%.

Xpeng Motors gambles intelligently.

I believe that how to return to the first echelon is the greatest wish of Xpeng Motors, and the answer given by He Xiaopeng is: intelligence. Before He Xiaopeng made the prediction of "7 companies in 10 years", there was still a sentence-"With the arrival of the AI ? ? big model era". That is to say, He Xiaopeng believes that many of the above-mentioned more than 10 car companies will be eliminated in the AI ? ? big model era, while Xpeng Motors will take this opportunity to stand on the forefront.

Earlier, He Xiaopeng publicly stated: "Even if Xpeng Motors is in the most difficult moment in 2019, it has never cut its investment in smart driving." In 2024 alone, the annual R&D expenditure of artificial intelligence in Xpeng Motors is as high as 3.5 billion yuan, and the advanced layout will be realized at the computing infrastructure level.

With the investment of huge R&D expenses, Xpeng Motors has made great achievements in intelligence, especially on the track of intelligent driving, and Xpeng Motors is a model of domestic car companies.

At the "AI Intelligent Driving Technology Conference" held in Xpeng Motors, He Xiaopeng said: "Xpeng Motors is the only car company that has achieved end-to-end mass production of large models." As for the first one, there is no doubt that it is Tesla, a global industry benchmark.

Xpeng Motors’s end-to-end big model technology route mainly consists of three parts, namely, neural network XNet, regulatory big model XPlanner and big language model XBrain. Relying on the end-to-end large-scale model technology, Xpeng Motors’s intelligent driving system XNGP has been successfully upgraded from "all available in the country" to a new stage of "all available in the country". Specifically, it is not limited to cities, routes and road conditions.

At that time, Xpeng Motors also said that XNGP has been tested and verified by real vehicles in more than 2,595 cities, with a cumulative test mileage of over 7.56 million kilometers, conveying that Tucki attaches great importance to the safety of smart driving with a saturated smart driving test that is rare in the industry.

In addition to riding on the smart driving track, Xpeng Motors also realized her desire to increase her income by relying on technology research and development. It is reported that in the first quarter of this year, Xpeng Motors’s service and other income was about 1 billion yuan, a year-on-year increase of 93.1%. Xpeng Motors said that this part of the revenue growth mainly comes from the technology research and development services provided by Xpeng Motors for Volkswagen’s platform and software strategy technology.

MONA M03, the steel wire at the foot of Xpeng Motors.

Relying on the development of intelligence, Xpeng Motors saw the dawn of soaring again. At the same time, intelligent driving has become the biggest advantage of the new car MONA M03.

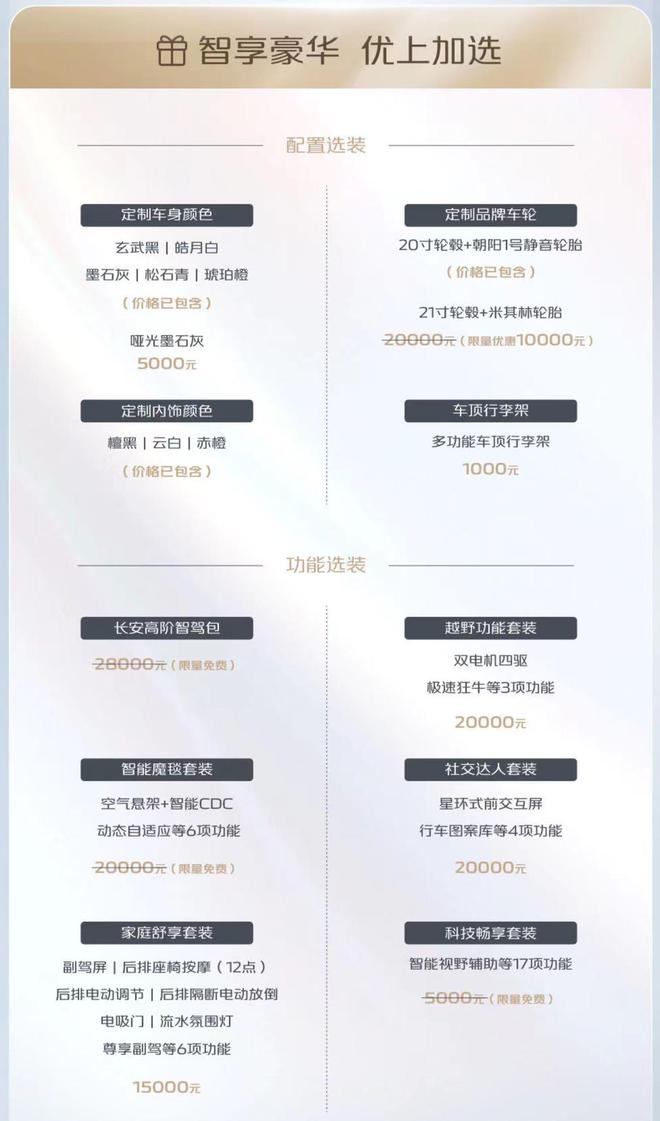

MONA M03 not only has Snapdragon 8155 chip, but also comes standard with 20+ intelligent sensing hardware, including 2 millimeter-wave radars, 12 ultrasonic radars and 7 cameras. The standard version of this car has L2-class intelligent driving ability and intelligent parking in the whole scene, while the MAX-class intelligent driving version is directly equipped with three millimeter-wave radars and dual NVIDIA DRIVE Orin chips, and is equipped with Tucki XNGP pure vision high-order intelligent driving assistance, which is the only urban high-order intelligent driving pure electric hatchback supporting pure vision processing scheme within 200,000.

Importantly, the price of MONA M03 is only 119,800-155,800 yuan.

Such a low price makes the market prospect of this car infinitely bright. According to the data of the National Information Center, at present, the high-level intelligent driving equipment rate of new energy vehicles with more than 300,000 yuan in China is nearly 100%. In the domestic passenger car market, the allocation rate of high-order intelligent driving is close to 0% for new energy vehicles in the market range of 80,000-200,000 yuan, which accounts for 74%.

But at the same time, it is hard to imagine how Xpeng Motors can make money with MONA M03 at such a low price. Yu Chengdong, managing director of Huawei, chairman of BG, and chairman of BU, a smart car solution, has publicly stated that Huawei’s high-end smart cars with a price below 300,000 yuan are actually sold at a loss.

In other words, Xpeng Motors’s decentralization of high-level intelligent driving to a market segment of 150,000 yuan means potential cost pressure and risks. However, He Xiaopeng is confident that MONA M03 can still make a profit even though it is sold cheaply. All pricing strategies must be based on reasonable profits. Through technological innovation and cost control, Xpeng Motors is confident to achieve profitability while ensuring product strength.

Regardless of whether it can make a profit in the end, at least for now, the sales of MONA M03 should be good. However, the potential risk of MONA M03 may be higher than the potential sales.

Many people know that the birth of MONA has a great relationship with the online car giant Didi. I even know that the sales of MONA M03 may be dripping. This also makes people think that MONA M03 will eventually become a special car for the online car market.

Yang Guang, the person in charge of MONA series products in Tucki, said that MONA does not make a "taxi version": the hatchback coupe is less competitive in making a network car; It is difficult to take care of both the network car and the C-end car, which will do harm to users. But at the same time, Yang Guang also said that MONA M03 can take into account the online car market. "But if you are willing to take M03 to run a car online, it will definitely be OK," said Yang Guangru.

Indeed, it is very difficult to take into account the B-end and C-end markets, and many brand models have already tasted the bitterness of failure. For example, Guangzhou Automobile Ai ‘an.

Nowadays, almost a consensus has been reached in the industry. The development of the online car market has made Ai ‘an taste the sweetness and seriously damaged their brand image. Ai’ an has successively launched models such as AION S Plus and AION S Max in an attempt to save the hearts of C-end users, but the online car label has been deeply rooted in the hearts of the people. On the one hand, C-end users avoid it; On the other hand, the B-end user group is still growing, and the situation in Ai ‘an has reached a stage where it is difficult to return.

In this way, the MONA M03 carefully built by He Xiaopeng is indeed facing great challenges. A little careless, Xpeng Motors is undoubtedly in the poison to quench thirst.