With the lifting of the ban on pickup trucks and the upgrading of consumption, as well as the change of Chinese people’s perception of pickup truck consumption, the consumption potential of pickup truck market continues to be released. As the leader of pickup trucks, the 2023 Great Wall Gun of "Global Smart Luxury Pickup Truck" was launched for five months, with sales exceeding 50,000 units. With the champion strength, it continued to lead the pickup truck riding, commercial and cross-country tracks, and led the value of pickup trucks in China to jump upward.

From passenger guns, commercial guns to off-road guns, the Great Wall gun integrates the comfort of cars, the off-road nature of SUVs, the leisure of station wagons and the loading of light trucks into one, achieving a real "family universal car", meeting the multi-purpose and multi-scene needs of users such as fashion life, entrepreneurship and wealth creation, and outdoor leisure, and becoming the first choice for pickup trucks in the new era. At present, the customized version and the alpine version of the Great Wall Gun have been listed one after another, bringing users a diverse and high-quality car experience.

Expand the passenger/commercial/off-road subdivision track to create a full-scene pickup life.

The Great Wall Cannon is not only a multi-purpose vehicle model suitable for IKEA, but also represents an infinite possible lifestyle. As an innovative masterpiece of the Great Wall Gun, 2023 passenger guns, 2023 commercial guns and 2023 off-road guns condense the wisdom of the king of Great Wall pickup trucks, making them smarter, more luxurious and safer, and creating a full-scene pickup truck life with users.

The 2023 passenger gun is positioned as a "global intelligent luxury pickup truck", and the whole vehicle is upgraded to L2+ intelligent driving assistance level. On the basis of the original ACC adaptive cruise, parallel line assistance and other functions, many configurations such as traffic congestion assistance and intelligent cornering are added, and it is the first to be equipped with a fully automatic parking system; Configure a new generation of vehicle networking system, support remote vehicle control, and realize remote operations such as unlocking/locking doors and starting/closing engines; The appearance adopts Chinese hard-core aesthetic design, equipped with matrix air intake grille, with penetrating muscle waistline, sharp eagle-eye dual-lens LED headlights, powerful wheel eyebrow shape, high-grade atmosphere; The brand-new exquisite technology wind interior adopts large-area soft coating, 7-inch color LCD instrument +12.3-inch Zhilian touch screen double suspension design, laser engraving process luminous decorative board, which is bursting with technology.

With the new upgrade of "intelligence, luxury, safety and comfort", the 2023 passenger gun has become a real champion pickup truck, once again breaking the traditional cognition of Chinese people on pickup trucks, leading users to travel through the bustling city and the vast world, so that everyone who loves life can enjoy the journey of life and feel the joy of life.

If the passenger gun is a good partner for users to gallop around the city and explore the outdoors, then the 2023 commercial gun positioned as "global intelligent luxury commercial pickup truck" is the best partner for business elites in the new era to start businesses and get rich.

The size of 23 commercial gun carriages reaches 1760*1520*540mm, and the chassis adopts high-strength trapezoidal frame and leaf spring, which leads the same level in loading capacity and bearing capacity, improving transportation efficiency and reducing logistics cost; Equipped with the top ten engines of 2.0T "China Heart" and ZF 8AT transmission, it forms a golden power combination. Combined with Borgwarner’s electronically controlled part-time 4wd, it is fearless of all rugged road conditions on the road to wealth creation and helps users seize the opportunity to get rich.

Peace is the premise of everything. The 2023 commercial gun has a high-strength cage body, a high-strength door anti-collision beam, four airbags, and the whole system comes standard with ESP body stabilization system, right front blind spot monitoring system and a million-pixel reversing image system to ensure personal safety at all times and truly create wealth without worry.

Relying on the five hard-core strengths of "super enjoyment of driving, super power, super safety, super load and super ingenuity", the 2023 commercial gun has become a right-hand man for users to earn money and support their families, from pulling goods and transportation to daily commuting, helping users to take off their careers and get rich.

In addition to the passenger and commercial fields, the Great Wall Gun launched the 2023 off-road gun "Global Intelligent Luxury Off-road Pickup" around the all-terrain off-road pickup subdivision track, and accompanied off-road enthusiasts to start an outdoor trip with the three hard-core strengths of "off-road, off-road heart and more fun".

The 2023 off-road gun changed people’s inherent impression of the pickup truck as a "tool car". The leopard-eye dual-lens LED blackened headlights, with the blackened champion belt net, conveyed the spirit of conquering and challenging; The maximum power of gasoline is 140kW and the peak torque is 360N• M, the maximum power of diesel power is 120kW, and the peak torque is 400N• M, matched with 8AT transmission, can easily cross all kinds of unpaved roads.

At the same time, the original 2023 off-road gun is equipped with hard-core equipment such as front and rear axle electronically controlled differential lock, K-MAN nitrogen off-road shock absorber, Bailuchi KO2 all-terrain tire, winch, wading throat, front and rear iron competitive bars, etc. Provide 6 driving modes: 2H, 4H, 4L, snow, mud and sand, and the unique off-road expert mode at the same level allows senior players to enjoy pure off-road fun; The whole system comes standard with ESP body stability system, equipped with high-level intelligent driving assistance; Equipped with 6 airbags, high-strength body, and 3mm thick chassis metal armor as standard in the original factory to ensure users’ driving safety.

From leisure home, business to off-road travel, the 2023 Great Wall Gun can be easily competent, achieving multi-scene and multi-purpose coverage, providing users with a smarter, more luxurious and safer car experience, and setting a new benchmark for the value of pickup trucks in China.

Great Wall Gun Customized Edition/Alpine Edition goes on the market to create a diversified car experience.

Progress never stops, and innovation never ends. Great Wall Gun, which insists on category innovation, has introduced customized version and cold version on the basis of passenger gun, commercial gun and off-road gun. Through continuous technical upgrading and product improvement, it meets diversified demands and provides more high-quality choices for China consumers.

Among them, the customized version of the Great Wall Gun is an exclusive model based on the needs of users in the southwest plateau mountainous area and the car scene. It comes standard with front fog lights, right front blind spot monitoring and 360-degree look around. In view of the characteristics of mountainous roads and poor visibility AT night in the southwest plateau, AT cross-country tires are standard in the whole system, which has larger tire patterns and stronger grip. At the same time, the customized version of the passenger gun supports crawling mode, tank turning and other functions; The customized MT model of commercial gun optimizes the power and improves the torque of the whole wheel rim by 60N?m.

The Great Wall Gun Alpine Edition is based on the needs of users in the northern alpine region and the scene of car use, and has made a number of innovative configurations and technical improvements, such as AGM large-capacity battery, four-wheel drive system, AT tire and seat heating, steering wheel heating, rearview mirror for vehicle defrosting, windshield nozzle heating, etc. It has obvious advantages in cold resistance and driving stability, and provides users in the northern alpine region with more choices and better car experience.

Redefining the pickup truck for four years, 500,000 units will open a new "Great Wall Gun Speed"

From a global perspective, pickup truck is the most popular and sold type of automobile products, and it is also one of the most dynamic automobile consumption carriers. The development and evolution of pickup trucks in China has far exceeded users’ cognition. Pickup truck is a real national car, which is not only the consumption on wheels, but also the value creator on wheels.

As the leader of pickup truck, Great Wall Gun redefined pickup truck, and was first equipped with the core technologies of passenger cars such as multi-link rear suspension, ZF 8AT, L2 intelligent driving assistance system and intelligent network connection, which changed the commercial characteristics of pickup truck and gave it the value and significance of riding. Driven by the Great Wall Cannon, more and more consumers realize that pickup truck has become a multi-purpose vehicle model of "one car for many cars", and it is a truly multi-purpose and multi-scene super category, which can meet all their needs for vehicle appearance, interior, performance and function.

Today, the Great Wall Gun has formed two categories: fashion, business, passenger and leisure, achieving a full lineup of 100,000-300,000, and full-scene product coverage, bringing users a high-quality car experience that is suitable for IKEA, multi-purpose and multi-scene. In August this year, Great Wall Gun rolled off the assembly line with its 500,000 th vehicle on the fourth anniversary of the brand, becoming the first high-end pickup truck brand in China to break through 500,000 vehicles, creating a new "Great Wall Gun Speed", which has been widely recognized by the market and users.

Up to now, Great Wall pickup truck has been ranked first in sales volume for 25 consecutive years, and its global cumulative sales volume has exceeded 2.45 million. It is the only pickup truck brand in China that has entered the "2 million club", and its domestic terminal market share is nearly 50%. For every two pickup trucks sold in China, one is the Great Wall. In the future, Great Wall Gun will continue to focus on users’ actual travel needs, and lead the pickup truck category with high-value products. While boosting the overall expansion of the pickup truck market in China, it will become the top three pickup trucks in the world, making China pickup trucks popular all over the world!

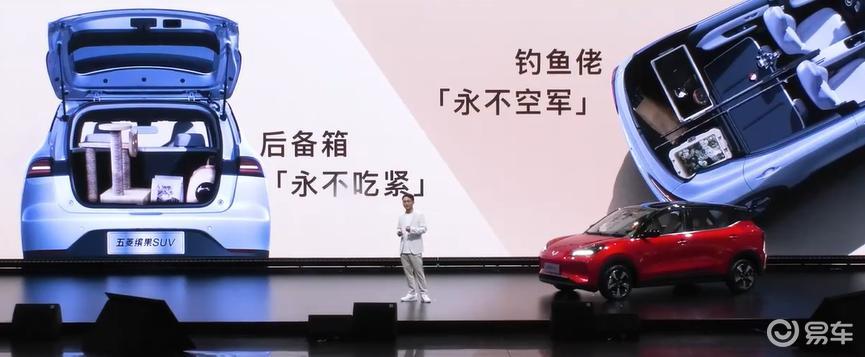

There is no doubt that after the five-seat version of Wuling Bingo SUV goes on the market, it will bring a lot of sales pressure to popular models such as BYD, Ai ‘an Y with overlapping prices.

There is no doubt that after the five-seat version of Wuling Bingo SUV goes on the market, it will bring a lot of sales pressure to popular models such as BYD, Ai ‘an Y with overlapping prices.