Foreign investors are firmly optimistic about the latest position exposure of A-share top-stream institutions such as UBS and Motong.

The disclosure of the third quarterly report entered the peak period, and the positions of top foreign-funded institutions attracted much attention from the market.

Recently, the shareholding data disclosed by A-share listed companies showed that foreign institutions such as UBS and JPMorgan Chase newly held multiple shares in the third quarter, while the Norwegian Central Bank and Goldman Sachs Group increased their holdings of some of their holdings. Generally speaking, foreign-funded institutions have increased their holdings of A shares with "real money and silver", mainly focusing on new energy and consumption sectors.

UBS has newly opened multiple shares.

Anhui Heli, Costar, Tianli Lithium Energy, Xianda, Keming Food and other shares disclosed the third quarterly report on October 22, and the positions of foreign-funded institutions were also announced.

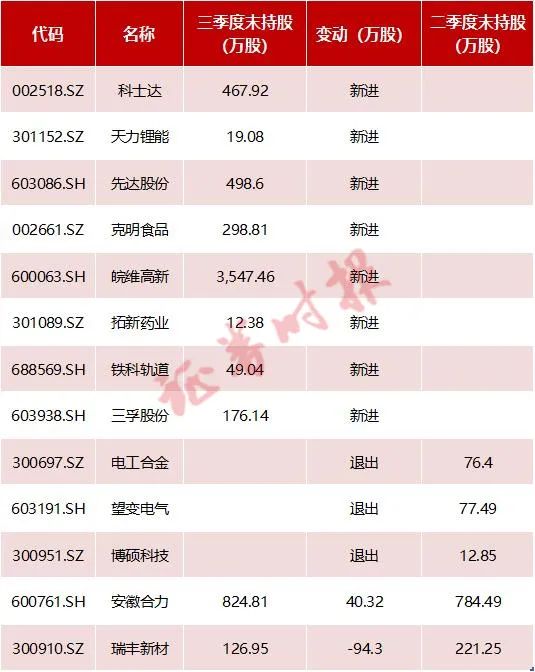

Wind data shows that up to now, UBS has appeared in the list of the top ten tradable shareholders of 10 listed companies, among which Costar, Tianli Lithium Energy, Xianda, Keming Food, Wanwei High-tech, Tuoxin Pharmaceutical, Tieke Railway, Sanfu and many other shares are new positions, Anhui Heli has been slightly increased, and Ruifeng New Materials has been reduced.

The latest position of UBS Group

Judging from the new shares of UBS, it is mainly in the sectors of new energy, consumption and medicine. Costar’s main business includes data center business, photovoltaic inverter, energy storage and charging pile. Based on UPS and data center business, the company has created the second growth curve of optical storage. Tianli Lithium Energy is a domestic lithium battery cathode material enterprise, which was listed on GEM on August 29th this year. The main products of Sanfu Co., Ltd. include trichlorosilane, silicon tetrachloride, optical fiber silicon tetrachloride, potassium hydroxide, potassium sulfate, special gas, etc. The products are widely used in photovoltaic, optical fiber, electronic chips and other fields. The above companies are all related to the new energy business, while Keming Food and Tuoxin Pharmaceutical are mainly related stocks in the consumer and pharmaceutical sectors.

JPMorgan Chase’s new position is Yaben Chemical, etc.

In the third quarter, the A-share market was adjusted to some extent, and many foreign-funded institutions took the opportunity to enter the market. Not only did UBS take many new positions in the third quarter, but JPMorgan Chase also took new positions in Yaben Chemical, Qingyi Optoelectronics, Shengde Xintai, Jinsanjiang and other stocks in the third quarter.

The data shows that JPMorgan Chase held 3,792,200 shares of Yaben Chemical at the end of the third quarter, with a market value of 39 million yuan, accounting for 0.4% of the tradable shares; Holding 1,332,300 shares of Qingyi Optoelectronics, with a market value of 27 million yuan, accounting for 1.63% of the tradable share capital; Holding 459,000 shares of Shengde Xintai, with a market value of RMB 13 million, accounting for 1.73% of the tradable share capital; It holds 483,600 shares of Jin Sanjiang, with a market value of RMB 10 million, accounting for 1.4% of tradable shares.

Among the top ten tradable shareholders of Yaben Chemical, except JPMorgan Chase, the reporter also found that Merrill Lynch also became the top ten tradable shareholders of the company in the third quarter, holding 3,601,500 shares, with a stock market value of 37 million yuan.

Yaben Chemical’s main business is the research, development, production and sales of innovative pesticide intermediates and pharmaceutical intermediates, and it is also one of the first companies in the domestic fine chemical industry to determine CDMO as its main business model.

The third quarterly report disclosed by Yaben Chemical shows that the company achieved operating income of 1.6 billion yuan in the first three quarters of 2022, down 0.24% year-on-year; The net profit of returning to the mother was 182 million yuan, a year-on-year increase of 20.42%.

Yaben Chemical said that the company’s overall operating income level maintained a growth trend, and the company’s good product quality, rapid response ability and timely delivery ability further enhanced the company’s cooperation with customers and further enhanced its profitability. In addition, the company has continuously optimized its business structure, and the growth of the original CDMO business, the expansion of the sales scale of its own products and the commissioning of new projects have also boosted its performance.

Bank of Norway Masukura Hongqi Chain

The three quarterly reports recently disclosed by Hongqi Chain and Haida Group show that the top ten tradable shareholders of the company appear as the Norwegian Central Bank. During the third quarter, the Norwegian Central Bank reduced its holdings of Haida Group and increased its holdings of Hongqi Chain.

Specifically, the Norwegian Central Bank held 19.7372 million shares of Haida Group at the end of the third quarter, with a stock market value of 1.19 billion yuan.

The Norwegian Central Bank also holds 25,428,800 shares of Hongqi Chain, with an increase of 2,235,000 shares in the third quarter, with a market value of 118 million yuan at the end of the period.

The Abu Dhabi Investment Bureau also appeared in the list of the top ten tradable shares of Haida Group. During the third quarter, the institution reduced its holdings of Haida Group by 1,146,700 shares, and its shareholding decreased to 10,737,900 shares at the end of the period, with a stock market value of 647 million yuan.

The British Columbia Investment Management Company also appeared in the list of the top ten tradable shareholders of Hongqi Chain, which increased its holdings by 3,040,900 shares in the third quarter, and increased its shareholding to 33,227,700 shares at the end of the period, with a stock market value of 155 million yuan.

Hongqi Chain is the largest commercial chain enterprise in western China, which integrates chain operation, logistics distribution and e-commerce. The main business is the chain operation of convenience stores, including daily necessities, tobacco and alcohol, food and other businesses. The third quarterly report shows that Hongqi Chain achieved an operating income of 7.573 billion yuan in the first three quarters of this year, and its revenue increased by 8.18% year-on-year; The net profit returned to the mother was 357 million yuan, with a year-on-year increase of 2.27%.

The company is a listed company focusing on research, development, production and sales of aquatic feed, livestock feed, aquatic feed premix and healthy breeding, with its core business being aquatic feed, aquatic fry and animal protection products. The third quarterly report shows that the company’s revenue from January to September was 78.955 billion yuan, a year-on-year increase of 22.76%; The net profit was 2.102 billion yuan, a year-on-year increase of 20.34%. Among them, the revenue in the third quarter was 32.629 billion yuan, a year-on-year increase of 24.91%; The net profit was 1.183 billion yuan, a year-on-year increase of 453.2%.

Goldman Sachs Group Masukura Ruifeng New Materials

There are many foreign-funded institutions in the list of the top ten tradable shareholders of Ruifeng New Materials, and Goldman Sachs Group and Goldman Sachs International rank fifth and seventh respectively.

The data shows that Goldman Sachs Group increased its holdings of Ruifeng New Materials by 351,600 shares in the third quarter, and the number of shares held at the end of the period increased to 3,782,100 shares, with a market value of 419 million yuan. Goldman Sachs International holds 2,000,000 shares of Ruifeng New Materials, and its shareholding has remained unchanged. At the end of the period, its market value was 222,000,000 yuan.

Ruifeng New Materials is mainly engaged in the research and development, production and sales of fine chemical products such as oil additives and carbonless paper color developers. The company has perfect production equipment and production technology, and by virtue of its technical and product advantages, it has developed into a leading supplier of lubricating oil additives in China and a major supplier of carbon-free paper developer in the world.

It is understood that the global demand for lubricant additives will be nearly 5 million tons in 2020, and it is expected to increase to 5.43 million tons by 2023. At present, the top four manufacturers in the world account for 85% of the market share, and the market share of Ruifeng New Materials is less than 2% in 2021. At present, the single-dose production capacity of Ruifeng New Materials exceeds 100,000 tons, and it has a large-scale capacity construction plan.

In 2021, Ruifeng New Materials passed the certification of APICI-4 and SN grade compound agent, and in 2022, it passed the certification of APISP grade compound agent. SP is the highest quality grade in the current specifications of gasoline engine oil in american petroleum institute, which can better adapt to China’s national six (b) emission standards. Essence Securities said that in 2022, the company made a breakthrough in the access of core customers, the sales of composite agents increased rapidly, and the transformation and upgrading achieved initial results. Essence Securities believes that after passing the API certification of advanced gasoline diesel engine oil compound, the company is expected to gradually seize the four major shares in rapid volume.

In addition, Goldman Sachs Group became the top ten tradable shareholders of Keming Noodle Industry in the third quarter, holding 2,474,400 shares with a stock market value of 28 million yuan.

The attractiveness of China stocks has further increased.

Roddy, asset management fund manager of UBS, said that the current changeable macro environment has brought some pressure to the steady growth of China, and the China stock market has also been under pressure recently. In the past, there was a certain correlation between the China stock market and the US dollar index. In May and June, due to the improvement of the macro environment in China, the impact of the US dollar index on the China stock market weakened, and the China stock market went out of an independent market.

For the market outlook, Roddy believes that "the attractiveness of China stocks has further increased, especially the valuation of small and medium-sized stocks represented by CSI 500 is at a historical low and more attractive."

According to Goldman Sachs Group, although the options market indicates that China-related assets may fluctuate in the near future, hang seng china enterprises index’s volatility is still lower than that of the S&P 500. They also said that investors should sell S&P 500 call options and buy hang seng china enterprises index call options. Compared with offshore stocks, Goldman Sachs prefers A shares because A shares are relatively less affected by global macro headwinds.

?

?