Selling 618-69800 yuan Wuling Hongguang S officially listed.

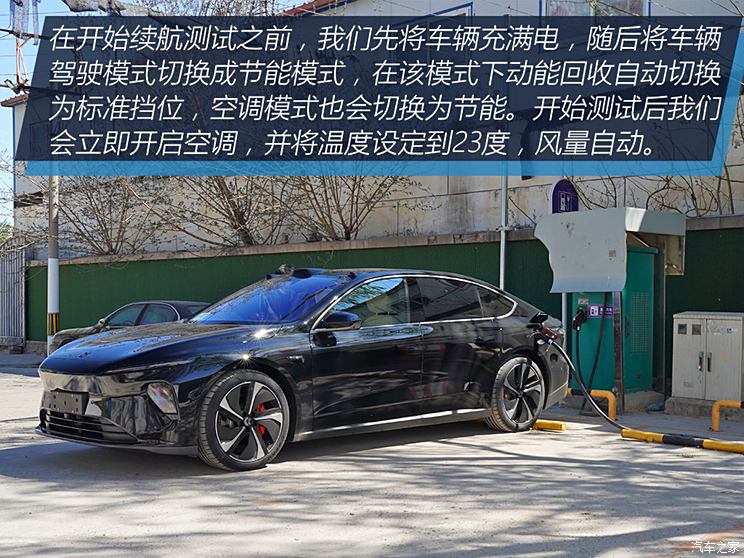

[Information] On August 6th, SAIC-GM-Wuling officially announced that S was officially listed. The new car listed this time is equipped with 1.2L and 1.5L models, and three models have been launched according to different configurations.The price range is 61,800-69,800 yuanPlease see the table below for the detailed selling price:

● New car features

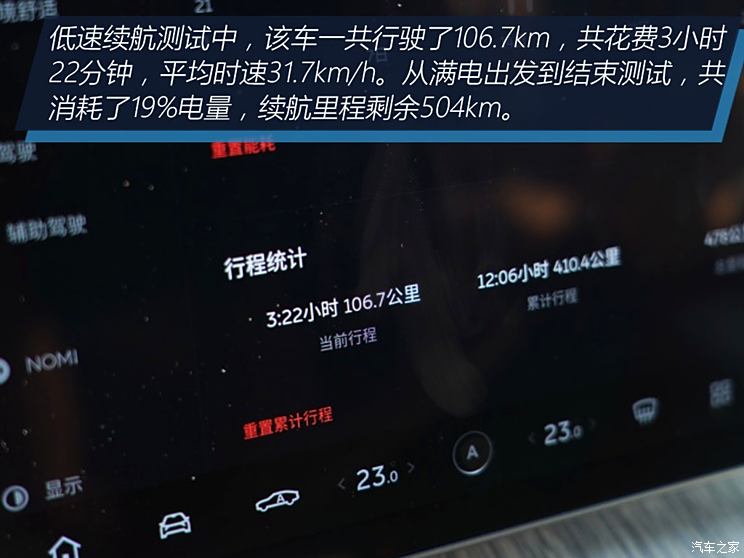

In terms of body size, compared with the current Wuling Hongguang, the length and height of the body of Wuling Hongguang S are slightly increased, and its appearance becomes more fashionable and sporty. While pursuing multi-purpose of one car, it pays more attention to family life and leisure.

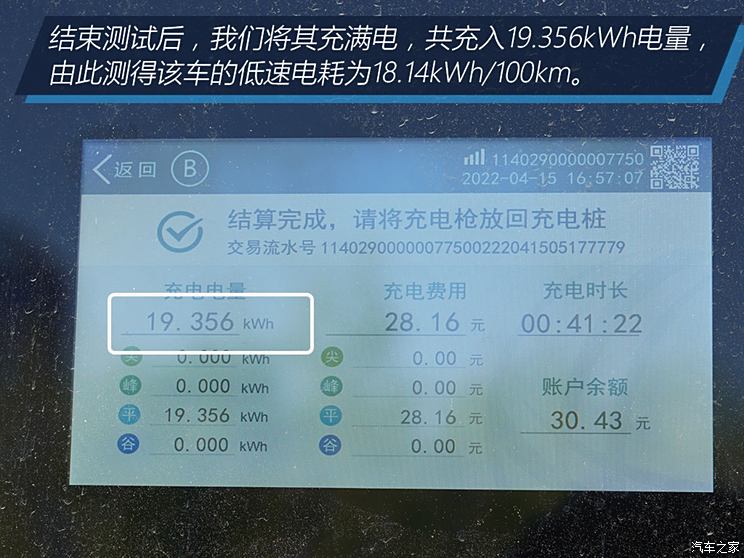

The change of Wuling Hongguang S in the front face is still obvious. The design style of the front air intake grille is more home-oriented, changed to quadrilateral design, and the front lower guard plate is added, which makes the cross-border style more intense.

In terms of interior, the style of the center console has also undergone a brand-new design, and it adopts a two-color design with a deep top and a shallow bottom, which is more fashionable than the cash, and the home style is also more intense. In addition, the high-profile models are also equipped with a 7-inch display and have functions such as Bluetooth and reversing images.

The manufacturer has made a variety of seat forms for customers to choose from for Wuling Hongguang S, which are 5 seats, 7 seats and 8 seats respectively. Among them, the 7-seat and 8-seat models can be folded and turned over, which can expand the storage space of the trunk and facilitate loading.

In order to cater to the favor of young consumers and home users, Wuling Hongguang S did not copy the conservative body color of Wuling Hongguang, but chose some more beautiful colors, and increased from the current six to eight, namely candy white, earth brown, quicksand gold, desert gold, clear sky silver, storm gray, coral red and sea blue. In addition, it still shows the determination to move closer to the family. Wuling Hongguang S abandoned the better bearing capacity and used the spiral connecting rod swing arm half with better comfort.

In terms of power, Wuling Hongguang S uses not only the 1.2L engine of Wuling Hongguang, but also the P-TEC 1.5L DVVT engine, with a maximum horsepower of 112 HP and a peak value of 147 Nm, which matches the engine with a 5-speed drive mode.

The new car is also rich in configuration. All models come standard with aluminum alloy wheels, driver’s seat, +EBD and audio system with CD+USB interface. The high-profile models also add remote control folding keys, 7-inch display, visual reversing radar and other practical configurations.

● New car background

In September, 2010, SAIC-GM-Wuling launched China’s first compact commercial vehicle product-Wuling Hongguang. The car has been recognized by the market for its smooth appearance and practical space. And with the monthly sales of about 30 thousand units, it has become the leading model in this market segment. However, in recent years, the cross-border wind has blown up in China, and the more comfortable and richer models are gradually favored by users. Therefore, the manufacturers have launched Wuling Hongguang S. On the basis of Wuling Hongguang, the car has increased its body size, replaced with a 1.5L engine and enriched its configuration, thus enhancing its freshness and competitiveness.

● Competitors

『』 『』

Since Wuling Hongguang achieved very good market performance, and Xiaokang, two old rivals, also found business opportunities in this market segment and successively launched their own products. The Ono model focuses on greater spatial performance; The well-off scenery of Dongfeng, which will be listed on September 1st at the beginning of next month, has a "family" dead ringer, both of which have their own characteristics. In addition, users who buy such models are quite sensitive to the price, so their pricing is very close. However, Wuling also has a more favorable advantage, that is, a huge user base and a good market reputation.

● Adapt to the crowd

After the listing of Wuling Hongguang S, it will be sold together with the current Wuling Hongguang. The two cars complement each other and can meet the car demand of more users. Wuling Hongguang is outstanding and practical, and most models use leaf spring rear suspension, which mainly meets the needs of users with partial load; Wuling Hongguang S is rich in configuration, colorful and beautiful, and it is equipped with a more powerful 1.5L engine, and the whole system uses spiral spring connecting rod swing arm semi-independent suspension, which will make the ride feel more comfortable. It faces those young and fashionable family users. (text/Home of the car Liu Wei)

Read more:

Try Wuling Hongguang S 1.5L luxury model close to family.

//www.autohome.com.cn/drive/201306/559381.html