Lei Jun, who earned 900 times in Lakara, shot again! Xiaomi smashed 200 million to establish a new venture capital company.

China fund newspaper Mo Fei

Speaking of the investment in the Internet circle, the ranking of Xiaomi founder Lei Jun can definitely squeeze into the forefront. Xiaomi investment, IPO harvester and more than 29 billion investment maps, a series of market labels also reflect Lei Jun’s amazing investment performance.

Today, angel investor Lei Jun has started a new layout.

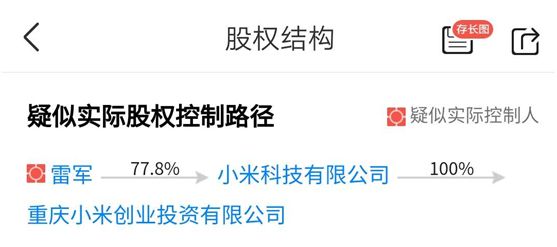

Recently, according to industrial and commercial data, Xiaomi Technology Co., Ltd. has set up a new venture capital company in Chongqing with a registered capital of 200 million yuan, which is 100% owned by Xiaomi Technology and the ultimate beneficiary is Lei Jun.

From the smart device unicorn company to the invested Xiaomi ecology, and the recent financial report reveals the investment records of more than 270 companies, Xiaomi’s investor attributes seem to be getting stronger and stronger.

Whether Lei Jun, who has a unique investment vision, will use this newly established venture capital company to let Xiaomi gradually move towards an investment platform company also makes all parties in the market ponder.

200 million newly established venture capital companies

Lei Jun is the ultimate beneficiary.

Recently, the latest information of industrial and commercial registration revealed another important thing that Lei Jun and Xiaomi Company behind him are preparing to do in the investment circle.

According to Tianyancha data, on June 5, 2019, Xiaomi Technology Co., Ltd. added foreign investment and established Chongqing Xiaomi Venture Capital Co., Ltd. with a registered capital of 200 million yuan.

From the perspective of equity relationship, this newly established Chongqing venture capital is 100% controlled by Xiaomi Technology Co., Ltd., and the ultimate beneficiary is Lei Jun. The main business scope of the company is venture capital and consulting business.

There has been market speculation that Xiaomi Company has invested heavily in setting up venture capital companies, which is related to the increasingly prominent financial investment attributes of the enterprise itself. Previously, the growth of Xiaomi’s smart equipment business was weak, but Xiaomi showed obvious aggressiveness in equity investment and obtained good investment income. At this time, the establishment of a venture capital company does not rule out the new strategic direction of Xiaomi’s transformation to an investment company in the future.

Xiaomi’s new venture capital company has also attracted heated discussion from netizens. Many netizens are optimistic about Xiaomi’s ability to cultivate new startups in the investment field, and expect Xiaomi’s ecology to continue to expand; Others believe that Lei Jun himself is good at venture capital, and the newly established company is undoubtedly returning to the field where Lei Jun is good at. How to develop in the future is worth looking forward to.

The book value is 29 billion yuan

Xiaomi investment empire surfaced.

Although from the perspective of investment volume and return, compared with the other two Internet performance giants Alibaba and Tencent, Xiaomi still has a big gap to cross. However, Xiaomi’s excellent investment ability has actually attracted great attention from the market.

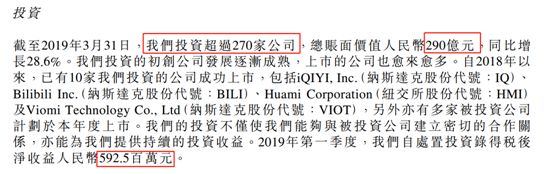

At the end of May, Xiaomi announced its financial report for the first quarter of 2019. According to the data, as of March 31, 2019, Xiaomi had invested in more than 270 companies with a total book value of 29 billion yuan, a year-on-year increase of 28.6%. Since 2018, 10 invested companies have been successfully listed. As of the first quarter of 2019, Xiaomi recorded a net after-tax income of 593 million yuan through investment.

It is worth noting that many companies invested by Xiaomi have been listed one after another, and their outstanding investment performance has also been dubbed as "IPO harvester" by the market. According to public information, since 2012, Xiaomi has invested in many related enterprises, such as iQiyi, Aauto Quicker, Youku Tudou, Today’s Headline, Little Information, Himalaya and so on.

In 2018 alone, 10 invested companies have successfully listed, including iQiyi, Bibi, Huami Technology, Yunmi Technology, Fun Headline, 51 Credit Card, etc. In addition, many invested companies plan to list in 2019.

In addition, among the declared enterprises in science and technology innovation board, eight enterprises, including Jinshan Office, No.9 Intelligent, Roborock, Chuangxin Laser, Lexin Technology, Juchen, Chuangxin Laser and Jingchen, are related to Xiaomi or Lei Jun..

According to Xiaomi’s prospectus, in 2015, 2016 and 2017, the realized investment income of Xiaomi was 534 million yuan, 29.5 million yuan and 283 million yuan respectively.

Judging from the stage of invested projects, Xiaomi mainly participated in the financing process of start-up enterprises within three years, and participated more in angel round and A round, such as the $310 million E round financing that led Thunder, and the Pre-IPO financing that participated in public comment and Cheetah Mobile.

Regarding the intention of investing in the company, Xiaomi has repeatedly stressed that it does not invest in finance, but hopes to cultivate the Xiaomi ecology. After the publication of a quarterly report, Xiaomi Zhou was funded to say that the CFO Zhou of Xiaomi Group was funded to say in a conference call that Xiaomi investment enterprises are not financial investments, but should have synergies with Xiaomi. Among the above-mentioned enterprises declared in science and technology innovation board, No.9And Roborock are exactly the Xiaomi eco-chain enterprises.

Lei Jun started his old job.

Building Xiaomi Ecology with Investment

In fact, Lei Jun, who was originally a venture capitalist, set up a venture capital company again at this time, which did not surprise too many people. The successful listing of Xiaomi in Hong Kong has long been regarded as Lei Jun’s most successful venture.

On Lei Jun’s Sina Weibo label, besides Xiaomi’s founder, chairman and CEO, Lei Jun is also the chairman of Kingsoft and an angel investor.

In addition to founding Xiaomi, Lei Jun also successfully led Jinshan Software to go public and held a 47.5% stake in Cheetah Mobile through Jinshan Software, which was successfully listed on NASDAQ in the United States. In 2003, Lei Jun realized personal wealth freedom by selling Joyo.com project to Amazon for 75 million dollars.

In 2005, Lei Jun invested in financial payment projects with a total capital of 4.3 million yuan.Company, and the prospectus in Lacarra shows that through the subsequent equity transfer, Lei Jun finally holds 1.13% equity of Lacarra with 250,000 yuan. Now Lacarra has successfully listed on the A-share market and become "the first share paid by China". Lei Jun has gained a return of more than 200 million yuan through this angel investment, and the return on investment is as high as 900 times.

In Lei Jun’s view, his investment method is more inclined to "acquaintance relationship". Previously, Lei Jun also revealed in his personal Weibo that "80% of the projects invested are very familiar people, and the rest are recommended by familiar friends. For example, VANCL (Fanke) is old, met in 1998, and began to do Excellence together in 2000; Yu Yongfu, known at the beginning of 2005, was the former vice president of Lenovo Investment, and was previously on the board of directors of Lacarra; Li Xueling, Duowan, known in 1998, was the former editor-in-chief of Netease. They have been my friends for many years and their abilities are excellent. "

In 2011, Lei Jun and Xu Dalai jointly established an independent investment institution, Shunwei Capital, and officially converted personalized investment into institutional investment. According to the data of Tianyancha, Xiaomi has invested in more than 200 enterprises in the past eight years, and Heshun has jointly invested in more than 110 enterprises.

Since Shunwei Capital holds 2.91% of Xiaomi’s shares at the same time, and Lei Jun’s personal investment behavior is relatively consistent with Xiaomi Company and Shunwei Capital, when it comes to Xiaomi’s foreign investment, the market will be classified as "Xiaomi Capital". Shunwei Capital was even labeled as "Xiaomi Investment Department".

It is worth noting that no matter Lei Jun personally, Shunwei Capital or Xiaomi Company, many investment projects are also around smart devices and Internet-related industries, which also makes the outside world pay a lot of attention to the "Xiaomi Ecology" carefully created by Lei Jun. Through the power of capital, it seems that it is becoming a brand-new strategic direction for Lei Jun to build Xiaomi’s future development by inciting projects in various fields of the Internet manufacturing industry and infiltrating Xiaomi’s models and values one by one.

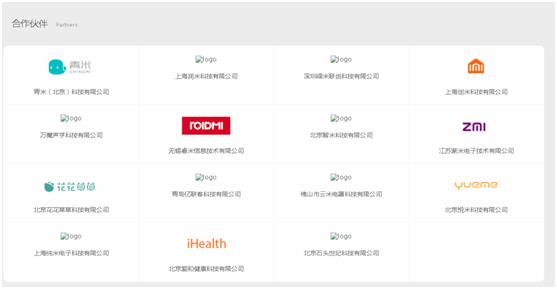

Judging from the current product line of Xiaomi, Xiaomi’s ecology around intelligent use scenarios has taken shape. Xiaomi’s subsidiaries and invested eco-chain enterprises have launched various products including air conditioners, water purifiers, balance cars, printers, smart bracelets, etc. Infiltrate various use scenarios such as home, office and travel. From smart phones, smart homes to smart life scenes, the ecological chain of "internet plus Smart Hardware" created by Xiaomi has been continuously enriched.

Only in the future, whether Xiaomi Company will rely on investment to build a new Internet company or completely transform an investment platform company through venture capital ability, maybe only time can tell us the answer.

“

Chinafundnews

Long press to identify the QR code and pay attention to the China Fund.

Qian Shan is always in love with thousands of waters. How about a "nice look"! ! !