Evergrande’s latest progress: Liquidators have surfaced!

Evergrande suspended trading to disclose the latest news.

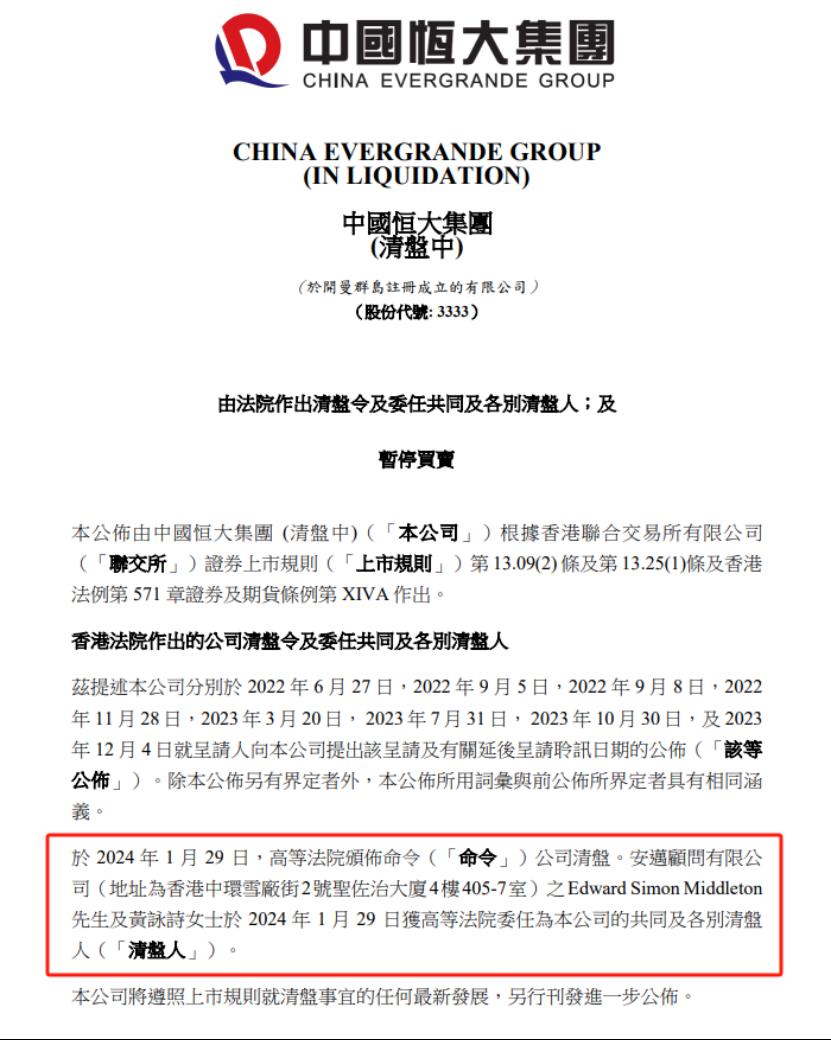

On January 29, China Evergrande announced that the Hong Kong High Court had issued an order for China Evergrande to be liquidated.

Among them, Edward Simon Middleton and Huang Yongshi of Anmai Consultants Limited were appointed by the High Court of Hong Kong as joint and separate liquidators of China Evergrande.

According to public information, Edward Simon Middleton and Huang Yongshi have extensive experience in company liquidation, having served as liquidators for Genting Hong Kong, Baitian Oil, and Crown Global Group.

China Evergrande said trading in its shares had been suspended since 10.18am on January 29 and would remain suspended until further notice.

Afterwards, Hengda Group CEO Sean responded to the media by saying that the subject of the overseas liquidation order issued by the court was China Evergrande, which was listed in Hong Kong. At present, the management and operation system of Hengda Group and other domestic and foreign subsidiaries as independent legal entities remains unchanged. The group will still make every effort to ensure the stability of its domestic business and operations, steadily advance key work such as guaranteeing the delivery of buildings, and maintain the quality of property services. It will still make every effort to ensure the smooth progress of risk resolution and asset disposal. It will still try its best to advance all work fairly in accordance with the law.

Evergrande liquidators surface

China Evergrande announced that Hengda had previously submitted petitions to China Evergrande on multiple occasions and postponed the hearing of the petition. On January 29, the Hong Kong High Court issued an order for China Evergrande to be liquidated.

Edward Simon Middleton and Wong Wing Sze of Anmai Consultants Limited were appointed by the High Court as joint and separate liquidators of China Evergrande.

It is reported that Anmai Consultants Limited is a private professional services organization that provides corporate consulting, business performance improvement, and restructuring, turnaround and bankruptcy services. The liquidators, Wong Wing-shih and Edward Simon Middleton, have extensive experience in company liquidation, having served as liquidators of Genting Hong Kong, Baitian Oil, Crown Global Group, etc. According to public information, on January 26, Wong Wing-shih and Edward Simon Middleton were appointed by the High Court of Hong Kong as joint and separate liquidators of Tengbang Holdings.

According to Hong Kong media reports, Huang Yongshi said that his team will make every effort to maintain the continuous operation of the group’s business, and the priority is to retain, restructure or continue to operate Evergrande’s business as much as possible. It will systematically retain the value of Evergrande, so as to increase the chances of creditors and other stakeholders to obtain repayment.

She said that within the framework of this liquidation process, the team will consider any possible restructuring options, and Anmai will first meet with Evergrande’s management to understand the group’s situation and discuss the next steps.

Huang Yongshi stressed that the liquidation order issued by the High Court is only for the parent company China Evergrande Group, and the liquidator will not have a direct impact on the operation of the group’s subsidiaries, especially the subsidiaries operating in the Chinese mainland, which will not be affected by the liquidation.

Yan Yuejin, Chief Research Officer of E-House Research Institute, told reporters that logically, liquidation means that the company stops operating. But given the characteristics of the mainland real estate market, it is expected to follow two lines. That is, at the same time as the liquidation, Evergrande’s property protection work still needs to be advanced, and it is expected that local governments will coordinate and coordinate.

Evergrande continues to suspend trading, the president responds

On January 29, after China Evergrande was exposed to a liquidation order issued by the court, three Hengda companies, China Evergrande, Hengda Property and Hengda Automobile, announced a suspension of trading during the trading session.

Before the suspension, China Evergrande reported HK $0.163/share, down 20.87%; Hengda Property reported HK $0.39/share, down 2.5%; Hengda Automobile reported HK $0.229/share, down 18.21%.

China Evergrande said it would continue to suspend trading until further notice.

On June 27, 2022, Top Shine Global Limited of Intershore Consult (Samoa) Limited (Jiasheng Global) filed a winding-up petition to China Evergrande, involving the amount of financial obligations of China Evergrande for HK $862.50 million, the petitioner was represented by Lian Haomin, and subsequently, China Evergrande submitted up to 8 applications for extension of the petition hearing until January 29, when the court issued a winding-up order.

In an interview with 21st Century afterward, Mr. Shawn, Evergrande’s chief executive, said: "Today’s court ruling is contrary to our original intention, and we can only say that we have done our best and are very sorry."

Sean said that next, the group will face difficulties and problems, take all legal compliance measures, under the premise of protecting the legitimate rights and interests of domestic and foreign creditors, steadily promote the normal operation of the group’s business, and will also actively communicate with the liquidator, cooperate with the liquidator in accordance with the law to perform relevant procedures, according to international practices, market rules to promote debt resolution and other work.

Sean also stressed that the subject of the overseas liquidation order issued by the court this time is China Evergrande, which is listed in Hong Kong. At present, the management and operation system of Evergrande Group and other domestic and foreign subsidiaries as independent legal entities remains unchanged. The group will still make every effort to ensure the stability of its domestic business and operations, steadily advance key tasks such as guaranteeing the delivery of buildings, and maintain the quality of property services. It will still make every effort to ensure the smooth progress of risk resolution and asset disposal. It will still try its best to advance all work fairly in accordance with the law.

Editor in Charge: Tactical Heng

Proofreading: Gao Yuan